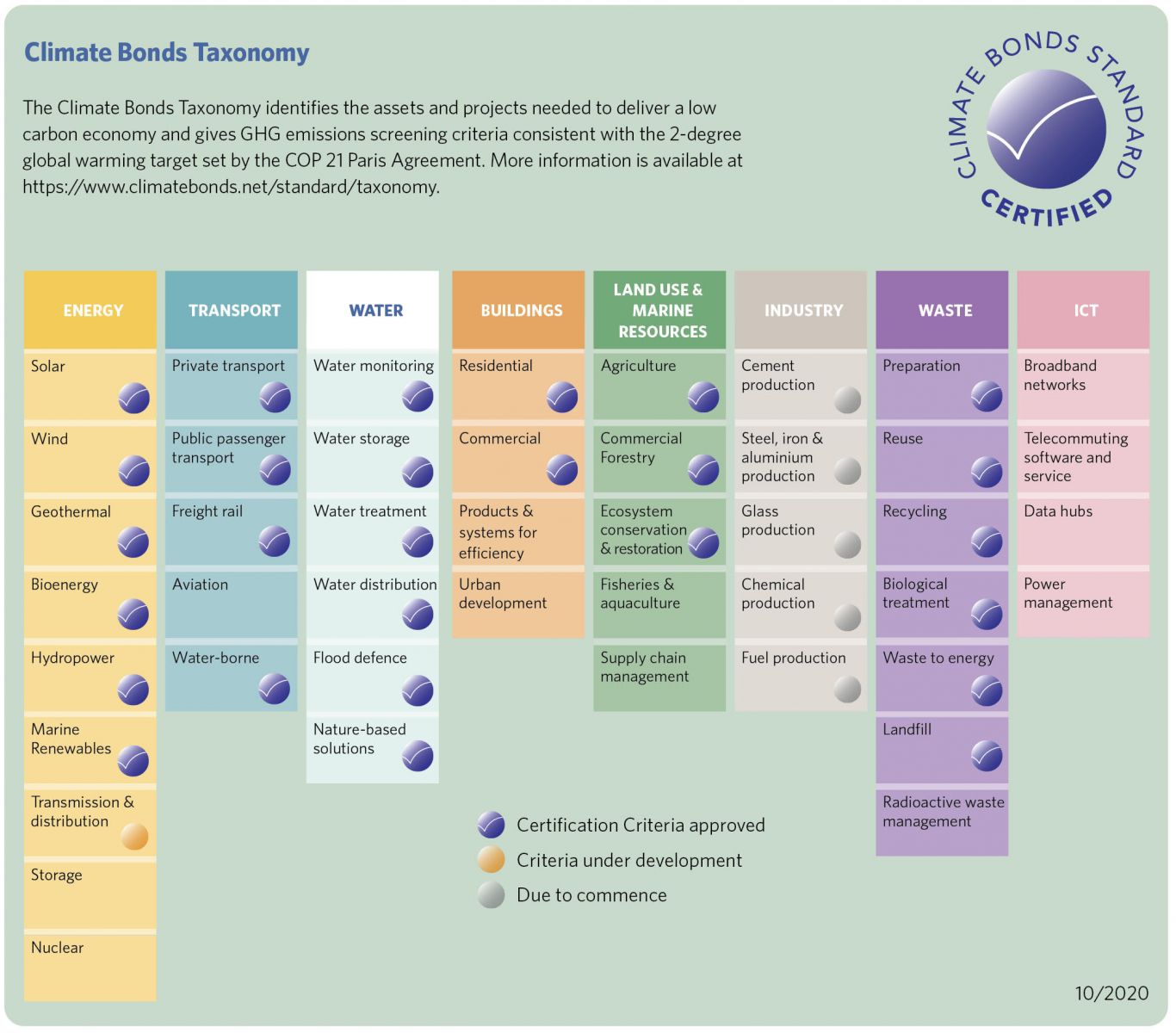

Climate Bonds Taxonomy

The Climate Bonds Taxonomy is a guide to climate aligned assets and projects. It is a tool for issuers, investors, governments and municipalities to help them understand what the key investments are that will deliver a low carbon economy.

The Taxonomy is grounded in the latest climate science and has been developed through an extensive multistakeholder approach, leveraging the work of our Technical and Industry Working Groups.

The Taxonomy aims to encourage and be an important resource for common green definitions across global markets, in a way that supports the growth of a cohesive thematic bond market that delivers a low carbon economy.

Climate Bonds has been a major contributor to the development of the EU Sustainable Finance Taxonomy, to find out more visit the EU Taxonomy.

|

English version (January 2021) |

|

Chinese version (as of 2018, to be updated) |

| Spanish version (January 2020) |

Reading the Taxonomy

The Taxonomy uses a traffic light system to indicate eligible assets and projects.

Context

A large number of institutional investors have indicated their support for action to address climate change. However, when it comes to environmental criteria, investors currently have too few tools to help ensure that their investments are making a significant impact, particularly for debt based investments. The market needs independent, science-driven guidance on which assets and activities are consistent with a rapid transition to a low-carbon economy. The Climate Bonds Taxonomy identifies the assets and projects needed to deliver a low carbon economy and gives GHG emissions screening criteria consistent with the 2-degree global warming target set by the COP 21 Paris Agreement. It has been developed based on the latest climate science including research from the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA), and has benefited from the input of hundreds of technical experts from around the world. It can be used by any entity looking to identify which assets and activities,

and associated financial instruments, are compatible with a 2-degree trajectory.

First released in 2013, the Climate Bonds Taxonomy is regularly updated based on the latest climate science, emergence of new technologies and on the Climate Bonds Standard Sector Criteria.

Through the development of the Climate Bonds Standard, we convene sector specific Technical and Industry Working Groups who work with us to identify assets and projects that are aligned with a 2-degree trajectory. All this research has been fed into the updated Climate Bonds Taxonomy.

The Taxonomy also includes the Sector Criteria, which provides in depth detail on what assets may be financed with Climate Certified Bonds and Loans.

For further information on Certification click here or contact certification@climatebonds.net