绿色基础设施在全球范围内带来了巨大的投资机会,从现在到2030年,为了实现《巴黎协定》的减排目标,估计需要价值1000亿美元的气候兼容基础设施。然而,仍然缺乏可识别的、可投资的和可融资的项目。此外,还缺乏对哪些类型的资产和项目有资格获得绿色融资的理解。

为应对这一挑战,气候债券倡议组织正在编写一系列报告,旨在识别和展示世界各地的绿色基础设施投资机会。通过这样做,它旨在提高人们对什么是绿色以及在哪里投资的意识,并推动发行绿色债券,作为为绿色基础设施融资的工具。

该系列报告从2018年5月推出的《印度尼西亚绿色基础设施投资机遇报告》开始,正在编制的GIIO报告包括进一步探讨亚太地区和拉丁美洲的机会。

绿色转型

报告还支持棕绿色转型的必要性。在中短期内,随着政府和大公司增加资本支出,并采用更环保的运营模式,它们将逐步减少对高碳资产和业务的敞口。当这些行业开始与2摄氏度的排放轨迹保持一致时,就可以创造新的绿色基础设施机会,比如航运和物流等行业。

报告: 澳大利亚 & 新西兰 • 巴西• 印度尼西亚• 菲律宾 • 越南 • 马来西亚 • 粤港澳大湾区

澳大利亚 & 新西兰

The GIIO Australia 2019 report advocates increasing green investment in the real economy including green bonds and other green investment products and greater engagement between the financial sector, ASX listed corporates, the superannuation sector and governments around infrastructure and brown to green transition.

This report builds on the inaugural Green Infrastructure Investment Opportunities Australia and Zealand (GIIO) report released August 2018.

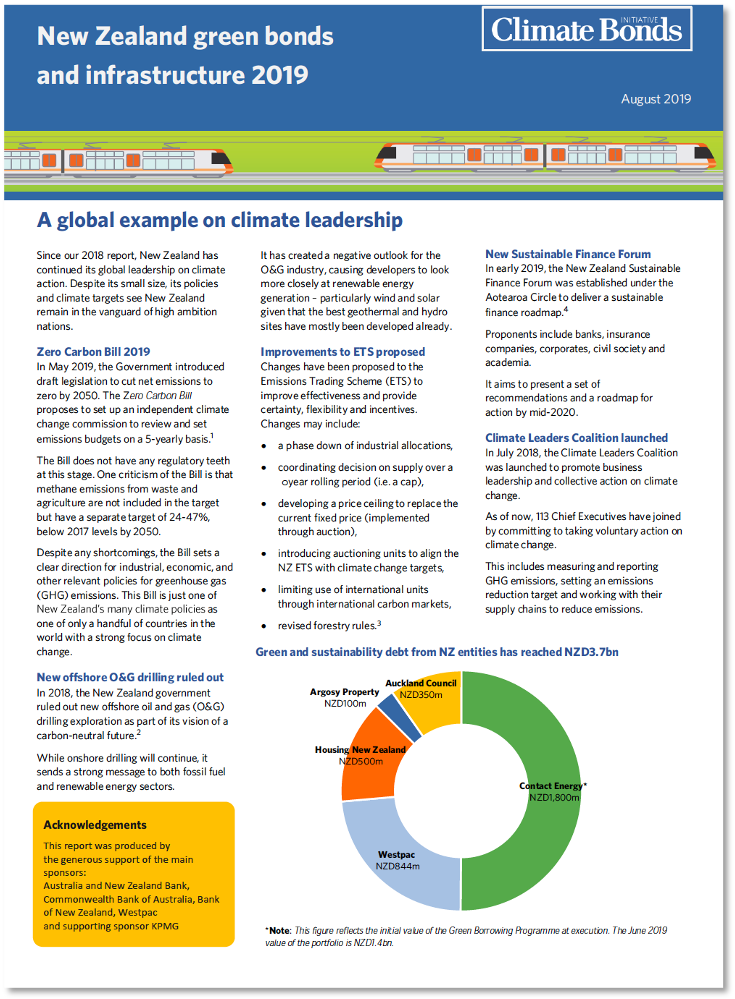

The New Zealand Green Bonds and Infrastructure 2019 report reveals that the existing green bond market in New Zealand is small but has momentum. The green loans market is also another area of promising growth in New Zealand. The report states New Zealand’s cumulative green and sustainability debt issuance is at NZD3.8bn as of 30 June 2019.

The GIIO Australia & New Zealand aims to facilitate greater engagement on these topics between project owners and developers, and institutional investors including asset managers and superannuation funds.

Green finance instruments and trends are explored in the report, with sector-by-sector green infrastructure investment opportunities presented in reference case studies.

O relatório Oportunidades de Investimento em Infraestrutura Verde — Brasil 2019 relaciona o atual estado do mercado brasileiro de finanças sustentáveis e o progresso de projetos de infraestrutura verde no Brasil.

The Green Infrastructure Investment Opportunities - Brazil 2019 report lists the current state of the Brazilian sustainable finance market and the progress of green infrastructure projects in Brazil.

印度尼西亚

This report builds on the inaugural Green Infrastructure Investment Opportunities, Indonesia report released in May 2018 (see below). It provides updated content to help meet the growing demand for green investment opportunities, including green bonds, as well as to support the country’s transition to a low-carbon economy.

Green Infrastructure Investments Opportunities, Indonesia was the first GIIO report developed. Released in May 2018, the report explores a wide variety of green investment opportunities in Indonesia. It has been prepared to support Indonesia’s mission to develop low carbon and climate resilient infrastructure; and aims to facilitate engagement on this topic between project owners and developers, and investors.

菲律宾

The Inaugural Green Infrastructure Investment Opportunities (GIIO) Philippines report brings the key trends and developments for green infrastructure and energy in the Philippines.

The Inaugural Green Infrastructure Investment Opportunities (GIIO) Philippines report brings the key trends and developments for green infrastructure and energy in the Philippines.

Twenty (20) green projects in renewable energy, low carbon transport, water infrastructure and waste management are showcased and a sample pipeline of over seventy (70) projects in low carbon transport, renewable energy, sustainable water and sustainable waste management are identified.

This report has been prepared to help meet the growing demand for green investment opportunities in the Philippines and to support the country’s transition to a low carbon economy. It aims to facilitate greater engagement on this topic between project owners and developers, and institutional investors. Green infrastructure and corresponding green finance instruments are explored in the report, with sector-by-sector investment options presented.

The report is intended for a wide range of stakeholders, including domestic investors, offshore pension funds and asset managers, potential issuers, infrastructure owners and developers, as well as relevant government ministries.

Webinar Launch: Philippines: Green Infrastructure Investment Opportunities (GIIO)

越南

Báo cáo Cơ hội đầu tư vào Cơ sở Hạ tầng xanh Việt Nam (GIIO Vietnam) khám phá nhiều cơ hội đầu tư xanh tại Việt Nam, nêu bật mười sáu (16) dự án năng lượng tái tạo, vận chuyển carbon thấp, cơ sở hạ tầng nước và giản lý chất thải. Các công cụ và xu hướng tài chính xanh cũng được liệt kê, phân tích trong báo cáo.

The GIIO Vietnam report explores a variety of green investment opportunities in Vietnam, highlighting sixteen (16) projects in renewable energy and green infrastructure including low carbon transport, water infrastructure and waste management. Green finance instruments and trends were also explored in the report.

The GIIO Vietnam report was launched on April 30th, 2020 during a webinar hosted by Climate Bonds that explored green infrastructure investment opportunities in Vietnam and Indonesia.

Webinar Launch: Green Infrastructure Investment Opportunity Vietnam

马来西亚

This report highlights green infrastructure investment opportunities in Malaysia. It has been prepared to help meet the growing demand for green investment opportunities and to support the country’s transition to a low carbon economy.

This report highlights green infrastructure investment opportunities in Malaysia. It has been prepared to help meet the growing demand for green investment opportunities and to support the country’s transition to a low carbon economy.

It aims to facilitate greater engagement on this topic between project owners and developers, and institutional investors. Green infrastructure and corresponding green finance instruments are explored in the report, with sector-by-sector investment options presented.

The report is intended for a wide range of stakeholders, including domestic superannuation funds and asset managers and their global counterparts, potential issuers, infrastructure owners and developers, as well as relevant government ministries.

In developing this report, the Climate Bonds Initiative consulted with key Government bodies, industry, the financial sector, peak bodies, NGOs and think tanks – in partnership with Capital Markets Malaysia. We would like to thank these partners along with the other organisations that contributed to the report.